Bitcoin ETF… these words are roaming around everywhere for a while. Possibly Bitcoin ETF could have been echoed in your ears too. That’s why you are here to know more about Bitcoin ETF.

Bitcoin ETF

Bitcoin, the volatile yet king of cryptocurrencies, has long captivated investors with its skyrocketing prices and tantalizing promises of revolutionizing finance. However, its wild swings and decentralized nature have also kept it out of reach for many mainstream investors. Enter the Bitcoin ETF: a game-changer poised to bridge the gap between traditional finance and the Wild West of crypto.

So, what exactly is a Bitcoin ETF?

Imagine a basket of apples, where each apple represents a fraction of a whole Bitcoin. An ETF acts like a farmer’s market vendor, selling slices of this “apple pie” on a traditional stock exchange. Investors can buy and sell these shares just like any other stock, gaining exposure to Bitcoin’s price movements without actually owning the cryptocurrency itself.

Why Bitcoin ETF a big deal?

Accessibility, my friend. ETFs offer several advantages over direct Bitcoin investment:

- Regulation and familiarity: Traded on familiar exchanges and overseen by financial authorities, ETFs provide a layer of comfort and protection that many traditional investors crave.

- Reduced risk and volatility: By avoiding the complexities of cryptocurrency exchanges and wallets, ETFs offer a smoother, less nerve-wracking ride for risk-averse investors.

- Diversification: Bitcoin ETFs can be bundled with other assets, spreading risk and creating a more balanced portfolio.

But hold your horses, before you empty your savings into Bitcoin ETFs, consider the flip side

- Futures-based ETFs: Many current Bitcoin ETFs track Bitcoin futures contracts, not the actual cryptocurrency. This can lead to discrepancies between ETF price and actual Bitcoin price.

- Regulation hurdles: The regulatory landscape surrounding crypto is still evolving, and future restrictions could impact ETF availability and performance.

- Fees and expenses: Like any investment vehicle, ETFs come with management fees that can eat into your returns.

So, should you invest in Bitcoin ETFs?

That, my dear reader, is a question only you can answer. Carefully weigh the pros and cons, consult a financial advisor, and remember: never invest more than you can afford to lose.

Bitcoin ETFs are undoubtedly a significant step towards mainstream crypto adoption. Whether they’re a gateway to financial freedom or a recipe for disaster remains to be seen. But one thing’s for sure: the future of finance is getting increasingly interesting, and Bitcoin ETFs are front and center in this thrilling drama.

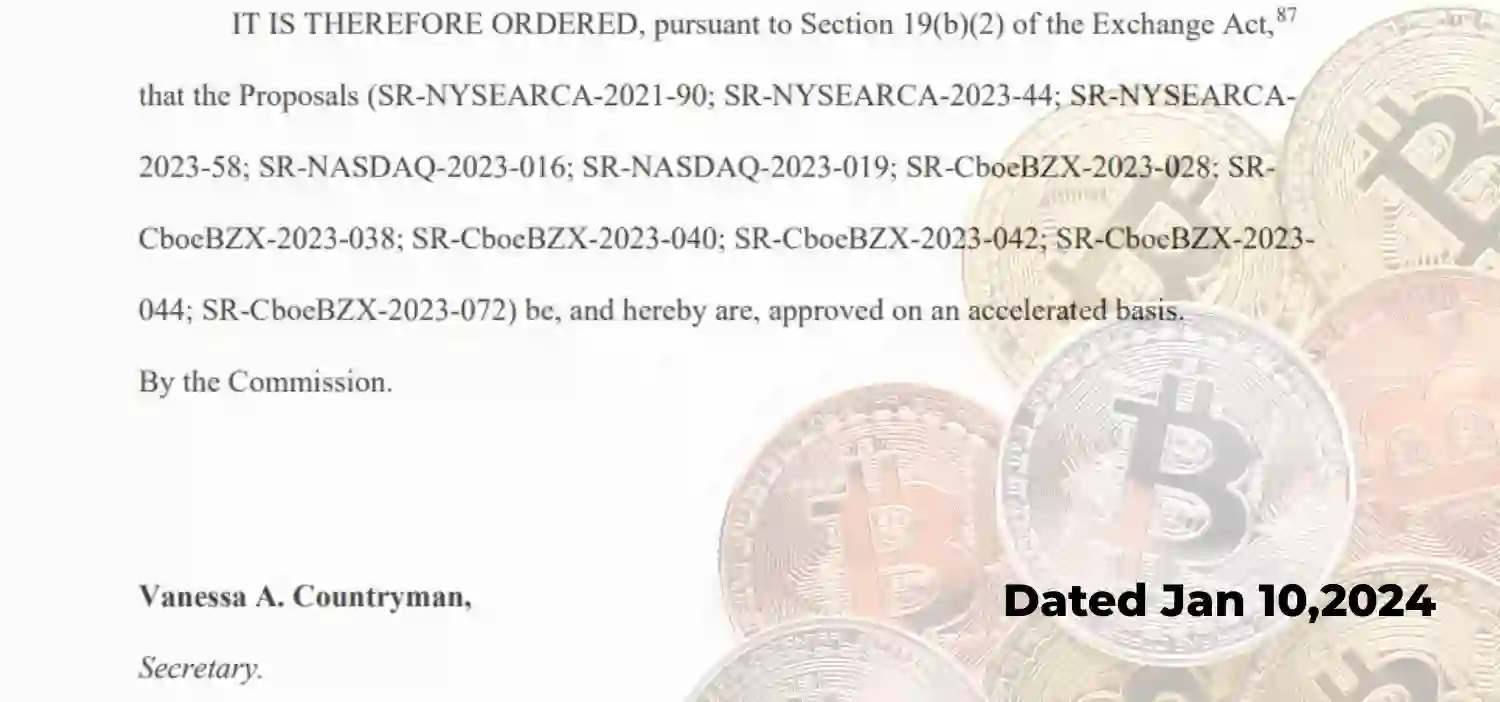

The Great Wall of Regulation Crumbles

After years of anticipation and countless rejections, the dam finally broke in January 2024. The US Securities and Exchange Commission (SEC) greenlit a whopping eleven applications for spot Bitcoin ETFs on January 10, 2024. This historic move sent shockwaves through the financial world, marking a turning point in cryptocurrency’s journey towards mainstream acceptance.

Where to Buy Bitcoin ETF?

Now, the question you’ve been patiently waiting for: where can you buy these coveted Bitcoin ETFs? Buckle up, because options abound! You can snag some shares at any major brokerage firm you might already use, like Fidelity, Schwab, or Vanguard. Online-only platforms like Robinhood and Webull also offer access to the digital feast.

But remember, not all ETFs are created equal. Do your research and compare offerings before diving in. Consider factors like expense ratios, tracking methodology (spot vs. futures), and underlying Bitcoin holdings.

A Word of Caution

The thrill of a new frontier often comes with hidden dangers. While Bitcoin ETFs offer a smoother entry point, remember that cryptocurrency remains a volatile beast. Tread cautiously, diversify your portfolio, and never invest more than you can afford to lose.

Before concluding, I have written a detailed blog for your Trading Success – Crypto Day trading strategies. You can do Short term investments in Cryptocurrencies such as Scalping, Swing Trading or Long term investments based on your choice.

There are smart ways to earn some FREE crypto coins such as Airdrops, ICOs, Bounty programs, Staking etc.

If you want learn & earn by trading Cryptocurrencies, you can learn in our profitz website – Practice more for overall success. You can do Scalping, Swing Trading, Investing in cryptocurrency.

So, dear reader, will you be an early adopter in this digital gold rush? The choice is yours. Just remember, knowledge is your pickaxe, and responsible investing is your compass. Navigate wisely, and who knows, you might just strike it rich in the Bitcoin ETF El Dorado!

Feel free to share your thoughts and questions in the comments below! Let’s keep the conversation flowing about this exciting new chapter in the world of finance.

Now, it’s your turn to weigh in! What are your thoughts on Bitcoin ETFs? Are you cautiously optimistic or downright skeptical? Share your insights in the comments below!