Take profit refers to the act of selling a portion or the entirety of an asset to lock in gains and realize profits. For a trader Stop loss plays a significant role in minimizing their losses. Take profit orders also equally significant in taking out the profit made.

In the volatile and rapidly changing landscape of cryptocurrency trading, this strategy holds immense significance for traders. It’s the deliberate action taken to secure the gains made from an investment or trade, preventing potential losses in case of a market downturn.

The cryptocurrency market is renowned for its unparalleled volatility, characterized by rapid price fluctuations that can yield significant profit opportunities. However, this very volatility also poses substantial risks, making it crucial for traders to take profit in their trades.

Suggestion

Take Profit & Stop Loss are the 2 most significant strategies in trading for securing the profits & minimizing profits for all Traders.

1. Volatility and Profit Potential

Cryptocurrencies exhibit extreme price swings within short time frames, offering ample chances for traders to capitalize on price movements. This volatility can result in substantial profits for astute traders who can effectively time their entries and exits.

Potential Gains: The market’s volatility often presents opportunities for substantial gains in a relatively short period.

Risks of Volatility: However, these price swings also heighten the risk of substantial losses if not managed properly.

2. Importance of a Well-Defined Profit-Taking Strategy

Amidst this volatility, having a meticulously crafted profit-taking strategy becomes paramount. It’s not merely about making profits but about safeguarding and securing those gains at the right moments.

Mitigating Risk: A well-defined strategy helps mitigate potential losses and protects profits by setting clear guidelines on when and how to take profits.

Discipline and Consistency: It instills discipline, preventing emotional decision-making, and ensures consistency in trading practices, crucial for long-term success.

3. Market Dynamics and Strategy Development

Dynamic Nature: The cryptocurrency market’s dynamic nature necessitates adaptability in profit-taking strategies. What works in one market condition might not be as effective in another.

Continuous Evaluation: Traders need to continuously evaluate and refine their profit-taking strategies, considering factors such as market trends, news, and technical analysis.

Short-Term vs. Long-Term Profit-Taking Strategies

1. Short-Term Profit-Taking

Involves taking profits relatively quickly such as Scalping, often within a short time frame Swing trading, as the asset’s value increases.

Utilizes technical indicators, market momentum, and short-term price movements to identify optimal points for profit-taking.

Tends to involve more frequent trades and a higher degree of active monitoring of the market.

2. Long-Term Profit-Taking

Focuses on capitalizing on the overall upward trend of an asset over an extended period.

Typically aligned with fundamental analysis, long-term growth potential, and the asset’s underlying technology or use case.

Involves less frequent trading and a more patient approach to allow the investment to mature over time.

Both short-term and long-term profit-taking strategies have their merits and drawbacks. Short-term strategies offer quicker gains but may involve higher transaction costs and increased exposure to market fluctuations. On the other hand, long-term strategies often require more patience and a strong conviction in the asset’s potential but can yield substantial returns over time.

Do you know there some Free ways to earn cryptocurrency such as Airdrops, ICOs (Initial Coin Offerings ), Bounty programs ( where you do a small task & get free crypto coins), Faucets, Crypto Mining or else you can just do the exchange of crypto coins for profit – it’s Arbitrage.

Setting Profit Targets

Setting clear profit targets before entering a trade is a fundamental aspect of successful crypto trading. It forms the backbone of a structured approach and helps in managing expectations while reducing impulsive decision-making. Here’s why it’s crucial:

Importance of Clear Profit Targets

- Guiding Trading Decisions: Clear profit targets provide a roadmap for your trades, enabling you to make informed decisions. They help in determining when to exit a trade and lock in profits.

- Risk Management: Having predefined profit targets aligns with risk management strategies. It allows you to calculate potential rewards against the risk taken for each trade, ensuring a favorable risk-to-reward ratio.

- Emotion Control: It helps in controlling emotions during trading. Emotions like greed or fear can cloud judgment, causing traders to deviate from their initial plan. Clear targets act as a discipline mechanism.

Factors to Consider for Profit Targets

- Technical Analysis: Utilize technical indicators such as support and resistance levels, moving averages, and chart patterns to identify potential profit-taking points. These indicators help in setting realistic and achievable targets based on historical price movements.

- Market Trends: Consider the prevailing market trends. In a bullish market, you might set more ambitious profit targets, while in a volatile or uncertain market, conservative targets might be more prudent.

- Risk Management: Assess the risk associated with each trade and set profit targets that align with your risk tolerance. A sensible approach involves not just considering potential gains but also factoring in potential losses to set realistic targets.

- Time Frame: Depending on your trading style (short-term or long-term), adjust profit targets accordingly. Short-term traders might have more frequent, smaller targets, while long-term investors might set larger, more spread-out targets.

- News and Events: Be mindful of upcoming news or events that could significantly impact the market. Adjust profit targets or consider exiting a trade earlier if there’s potential market volatility due to these events.

Types of Profit-Taking Strategies

A. Scaling Out Strategy

The scaling out strategy in crypto trading involves the gradual selling of portions of your position as the price of the asset increases. Instead of selling the entire position at once, traders opt to take profits in increments as the market moves favorably.

Explanation of Scaling Out

When you enter a trade and the price starts to rise, implementing a scaling out strategy means selling a percentage of your holdings at predefined price points or intervals. For instance, if you bought a certain cryptocurrency at $100 and it reaches $150, you might decide to sell 25% of your holdings. If the price continues to rise, you could sell another portion at $200, and so on.

Advantages of Scaling Out

- Reduced Exposure: By gradually selling portions, you mitigate the risk of losing out on potential profits if the price suddenly reverses.

- Locking in Gains: It allows you to secure profits along the way without completely exiting the position too early.

- Emotional Control: Helps in managing emotions and the temptation to be greedy or fearful, as profits are secured systematically.

Disadvantages of Scaling Out

- Missing Out on Full Upside: If the price keeps rising significantly after you’ve sold portions, you might miss out on potential larger gains.

- Complexity in Execution: Requires consistent monitoring and decision-making to determine the selling points, which can be challenging for some traders.

- Transaction Costs: Selling in increments may result in higher transaction fees compared to a single sell order.

Implementing a scaling out strategy demands a balance between securing profits and staying exposed to potential market movements. It’s crucial to have a clear plan in place, outlining at which price levels or intervals you intend to scale out and how much of your position you aim to sell at each point.

This strategy aligns with the principle of locking in profits while still allowing for exposure to further price appreciation. Each trader’s approach might differ based on their risk tolerance, market analysis, and the specific dynamics of the assets they’re trading.

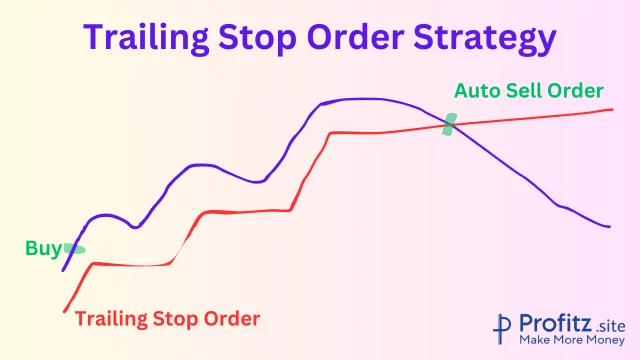

B. Trailing Stop Orders

Trailing stop orders are a popular tool among traders to secure profits while allowing for potential further gains in volatile markets like cryptocurrencies. This strategy involves setting a stop price that adjusts automatically as the asset’s price moves favorably. Here’s a breakdown of how trailing stop orders work and their benefits in profit-taking:

Defining Trailing Stop Orders and How They Work

Trailing stop orders function by setting a stop price as a percentage or a fixed amount below the current market price for a long position or above for a short position. As the market price moves in a favorable direction, the stop price “trails” or follows at a predetermined distance.

For example, if you set a trailing stop order of 5% below the market price for a long position, as the price rises, the stop price also rises, maintaining the 5% difference. However, if the price reverses and falls by 5% from its highest point, the order is triggered, locking in profits or limiting losses.

Benefits of Using Trailing Stop Orders in Profit-Taking

- Locking in Profits: Trailing stop orders help capture profits as the price increases without the need for constant monitoring. This automated approach secures gains if the market suddenly reverses.

- Flexibility in Riding Trends: They allow traders to benefit from extended price movements without prematurely exiting a trade. Trailing stops adjust with the market, enabling traders to stay in profitable trades longer.

- Risk Management: Trailing stops assist in managing risk by dynamically adjusting the exit point, reducing the potential for significant losses during market fluctuations.

- Emotion Control: By automating the profit-taking process, trailing stops remove emotional biases and reduce the temptation to intervene impulsively, helping traders stick to their predefined strategy.

Considerations when Using Trailing Stop Orders

Volatility and Market Conditions: High volatility might lead to more frequent triggering of trailing stops. Traders need to consider the asset’s typical price movements and set trailing distances accordingly.

Placement of Trailing Stops: Understanding the right distance for trailing stops is crucial. Too tight might result in premature exits, while too wide could expose the trader to increased risk.

Trailing stop orders offer a dynamic and automated way to secure profits while allowing for potential upside in crypto trading. When used alongside other strategies and risk management techniques, they can be an invaluable tool for traders seeking to optimize their profit-taking approach.

C. Taking Profit at Key Levels – Support & Resistance

In the volatile world of crypto trading, identifying support and resistance levels is fundamental. These levels represent points where the price has historically had difficulty moving beyond (resistance) or where it tends to find support (support). Leveraging these levels for profit-taking can be an effective strategy.

1. Identifying Support and Resistance Levels

Utilize technical analysis tools like trendlines, moving averages, and chart patterns to identify key levels.

Historical price data analysis helps in pinpointing significant support and resistance zones.

2. Determining Profit-Taking Points

When the price approaches a resistance level, consider taking profits as it might face selling pressure.

At support levels, observe for potential bounce-backs and consider taking profits if the price shows signs of reversal.

Example Strategy

Let’s say Bitcoin (BTC) has been trading within a range with $50,000 as a resistance level and $40,000 as a support level. A trader might decide to take profits when BTC approaches $50,000 by selling a portion of their holdings. Conversely, if BTC hits $40,000 and shows signs of rebounding, they might consider taking profits if they anticipate a potential reversal.

Importance of Risk Management in Profit-Taking

Effective risk management is the cornerstone of successful trading, especially when it comes to profit-taking in the volatile world of cryptocurrencies. Here’s why it matters:

- Capital Preservation: Risk management ensures that you protect your capital. Even when aiming for profits, it’s crucial to avoid overexposure to risk that could potentially wipe out gains or even lead to losses.

- Emotional Stability: Having a risk management plan in place helps in maintaining emotional stability. Fear and greed often influence profit-taking decisions, but a well-defined risk management strategy can mitigate these emotions.

- Consistency: Consistent application of risk management principles ensures that you don’t let a few bad trades disrupt your overall strategy. It allows for a disciplined approach, focusing on the long-term rather than chasing short-term gains.

Emotions and Psychology in Profit-Taking

The cryptocurrency market, with its extreme volatility and rapid price movements, is a breeding ground for emotions to run high. Emotions like greed, fear of missing out (FOMO), and fear of loss can significantly impact a trader’s decision-making process, especially when it comes to taking profits.

The Psychological Aspect

1. Greed vs. Fear

Greed: It’s common to want to squeeze out every possible gain from a trade. However, greed can lead to holding onto a position for too long, missing optimal profit-taking opportunities.

Fear: Conversely, the fear of missing out on further gains might prevent a trader from taking profits at a reasonable level, leading to potential losses if the market reverses.

2. Overconfidence

Successful trades can breed overconfidence, leading to a reluctance to take profits at a predetermined level. This overestimation of abilities can result in ignoring initial plans and risking more than intended.

Emotional Influence on Decision-making

1. Impact on Strategy

Emotions can cause deviation from a well-thought-out profit-taking strategy. Traders might impulsively sell or hold based on emotions rather than analysis, affecting their overall profitability.

2. Confirmation Bias

Traders might seek out information that aligns with their emotions, leading to confirmation bias. This can cloud judgment and influence profit-taking decisions.

Mitigating Emotional Effects

1. Setting Clear Rules

Establishing strict rules for profit-taking in advance can help mitigate emotional influence. Stick to predetermined profit targets and exit strategies regardless of emotional impulses.

2. Utilizing Stop Loss and Take Profit Orders

Implementing stop-loss orders and take-profit orders can automate the process, ensuring trades are executed according to the predefined strategy, irrespective of emotions.

3. Mindfulness and Patience

Practicing mindfulness and patience can help in controlling emotions. Taking breaks, stepping away from the screen, and reevaluating the market with a clear mind can prevent impulsive decisions.

Seeking Support and Mentorship

1. Community Engagement

Engaging with trading communities or having a mentor can provide perspective and emotional support, especially during times of high volatility or uncertainty.

2. Learning from Mistakes

Reflecting on past trades where emotions influenced decisions can serve as a learning experience to improve emotional control in future trades.

To Summarize

Due to high crypto volatility, guiding traders towards maximizing gains and minimizing risks is important.

Structured Approach for Profit-Taking: A structured approach isn’t just about knowing when to cash out—it’s about meticulous planning, setting clear profit targets, and employing diverse strategies tailored to different market scenarios. This structure not only safeguards profits but also helps in avoiding emotional decisions driven by market fluctuations.

Personalized Strategies: No one-size-fits-all solution exists in the realm of crypto trading. Encouraging the development of personalized profit-taking strategies rooted in extensive research and astute market analysis is crucial.

Suggestion

What works for one trader might not work for another due to varying risk appetites, trading styles, and market conditions. Choose the best approach that suits you based on your experience.

Adaptability and Flexibility: Market conditions can change swiftly, and what might have been an ideal profit-taking strategy yesterday, might need adjustments today. Being adaptable and flexible is as important as having a well-defined strategy. It enables traders to pivot in response to evolving market trends, news, and volatility.

Remember, while profits are vital, protecting your investment capital is equally crucial – So set your Stop loss for all your trades.

Keep learning, keep evolving, and let your strategies reflect the wisdom gained from both successes and setbacks in the crypto world.

Happy Trading!