What is STOP LOSS?

Stop loss in cryptocurrency refers to a predetermined price level set by a trader to limit potential losses on a specific trade. It acts as a safety net, automatically executing a sell order when the cryptocurrency’s price hits a specified threshold. This risk management tool aims to protect traders from significant losses in highly volatile crypto markets.

In simpler terms, if you have opened a trade assuming price will go higher, unfortunately if price goes down – if you have setup your stop loss, your trade will be automatically closed with the limited loss on what you have set as stop loss. If you haven’t, then you would be severe loss.

This is the reason Stop loss is a important topic / strategy to be learnt by all traders especially Crypto traders due to it’s more volatility. And you are already on track learning this strategy – I’m sure you are going to save thousands of dollars in future just by minimizing your losses.

Suggestion

It’s one of the risk management strategies, but the most important one or even the first one. I recommend you to set Stop loss price point to all your trades, no matter the type of trading you do, what type of currencies you trade (Forex, Cryptocurrency, Commodities trading etc)

Let’s go further how to use Stop Loss in your trades.

Importance of Risk Management in Volatile Markets

Cryptocurrency markets are renowned for their volatility, characterized by rapid price fluctuations. The unpredictability poses both opportunities and risks. Effective risk management is crucial to safeguarding capital and ensuring sustainable trading practices. Implementing stop loss strategies is a fundamental aspect of this risk management approach.

Do you know there some Free ways to earn cryptocurrency such as Airdrops, ICOs (Initial Coin Offerings ), Bounty programs ( where you do a small task & get free crypto coins), Faucets, Crypto Mining or else you can just do the exchange of crypto coins for profit – it’s Arbitrage.

Benefits of Using Stop Loss

1. Limiting Losses: Stop loss orders help traders limit potential losses by automatically selling a cryptocurrency when its price reaches a predetermined level, minimizing exposure to further downside.

2. Emotion Control: They assist in controlling emotional decision-making by providing a predefined exit plan, reducing the impact of impulsive reactions to market fluctuations.

3. Risk Mitigation: By setting stop loss orders, traders can manage their risk exposure and protect their trading capital, enabling a more disciplined approach to trading.

4.24/7 Market Coverage: Cryptocurrency markets operate round the clock. Stop loss orders allow traders to protect their positions even when they are unable to actively monitor the market, providing a sense of security.

Stop Loss Orders and Their Mechanics

In cryptocurrency trading, a stop loss order is a predetermined instruction set by a trader to automatically sell a specific cryptocurrency once its price reaches a certain level. This level is known as the “stop price” or “trigger price.” When the market hits this price point or goes below it, the stop loss order converts into a market sell order, executing at the best available price.

Types of Stop Loss Orders

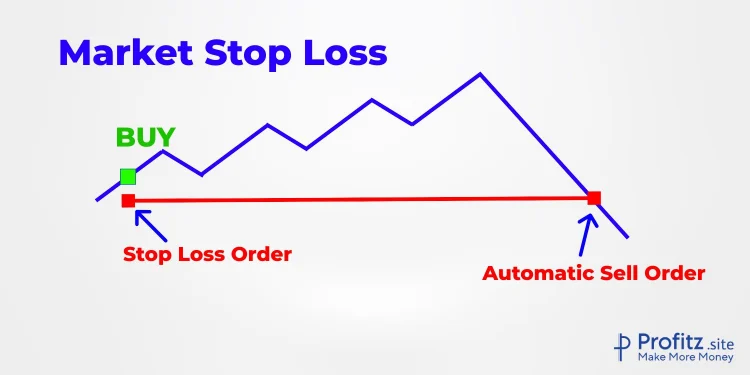

1. Market Stop Loss: This type of order triggers a market sell once the stop price is reached. It executes at the current market price, which could vary from the stop price in highly volatile markets.

2. Limit Stop Loss: Unlike market stop loss, the limit stop loss order sells the cryptocurrency at a specified price or better. It ensures the trade is executed at a predetermined price or a more favorable one if available.

3. Trailing Stop: A trailing stop loss order is dynamic and adjusts with the price movement. It trails the price at a set distance, maintaining a percentage or dollar amount below the market price. If the price rises, the stop price also rises, protecting profits. However, if the price drops, the stop price remains unchanged.

Setting Stop Loss Strategies

1. Determining the Right Stop Loss Percentage or Price Point

Determining the stop loss percentage or price point involves a blend of factors:

Volatility Analysis: Consider the historical volatility of the cryptocurrency. Higher volatility might warrant a wider stop loss.

Asset-Specific Factors: Assess unique factors affecting the asset, such as news, events, or market sentiment.

Support and Resistance Levels: Identify crucial support and resistance levels on the price chart to inform your stop loss placement.

Risk-Reward Ratio: Align stop loss with your desired risk-reward ratio for each trade. Ensure potential losses are acceptable within your risk management plan.

2. Tailoring Stop Loss to Individual Risk Tolerance and Trading Style

Risk Appetite: Determine how much risk you are comfortable taking in a trade. Conservative traders might opt for tighter stop losses, while aggressive traders might allow more flexibility.

Time Horizon: Adjust stop losses based on your investment horizon. Short-term traders might have tighter stop losses compared to long-term investors.

Position Sizing: Factor in the size of your position relative to your overall portfolio. Larger positions might necessitate wider stop losses to accommodate market fluctuations.

3. Using Technical Analysis to Place Strategic Stop Loss Orders

Chart Patterns and Indicators: Analyze chart patterns, trendlines, moving averages, and other technical indicators to determine potential entry and exit points for stop loss orders.

Confirmation Signals: Look for confirmation signals that validate your stop loss placement, such as volume trends or convergence/divergence in indicators like MACD or RSI.

More the volume keep your stop loss wider, lesser the volume tighten the stop loss.

Each trader’s approach to setting stop losses can vary significantly. I’m different, you are different. My trading strategies may not align with yours. The same applies to the Stop Loss Price levels.

Suggestion

There’s no precise price point / percentage where you should place your Stop loss. But, there’s one golden rule – It’s how much risk you are willing to take.

It’s essential to experiment with different strategies and find what aligns best with your risk tolerance, trading goals, and the specific dynamics of the cryptocurrency market you’re navigating. Regularly reassess and refine your stop loss strategies as market conditions evolve.

Common Mistakes and Pitfalls

1. Setting stop loss too close or too far from entry point

Overly Tight Stop Loss: Placing a stop loss order too close to the entry point increases the likelihood of premature triggering due to regular market fluctuations. This may result in frequent exits before a trade has had a chance to develop.

Overly Wide Stop Loss: Conversely, setting a stop loss too far from the entry point might expose the trade to significant losses before triggering. This could erode potential profits and negate the risk management purpose of the stop loss.

2. Ignoring market conditions and setting arbitrary stop loss levels

Blind Application of Fixed Percentages: Failing to consider the specific market volatility and trends when setting stop loss levels can lead to arbitrary decisions based solely on a fixed percentage. This overlooks the nuances of market behavior, potentially exposing trades to unnecessary risk.

Disregarding Fundamental Factors: Ignoring crucial market news, events, or fundamental shifts can result in setting stop loss levels without accounting for potential sudden changes in the market sentiment, leading to unexpected losses.

3. Not adjusting stop loss as the trade progresses

Static Stop Loss: Markets are dynamic, and trade conditions change over time. Failing to adjust stop loss levels as the trade evolves can either lock in profits too early or expose the trade to unnecessary risk by not securing gains or limiting losses appropriately.

Failure to Trail Stops: Particularly in trending markets, traders might neglect to employ trailing stop loss techniques, missing opportunities to secure increasing profits while protecting against potential reversals.

Avoiding these common pitfalls requires a proactive approach to setting and managing stop losses. It involves regularly reassessing the trade, considering market dynamics, and adjusting stop loss levels accordingly to strike a balance between risk and potential gains.

Suggestion

Take Profit & Stop Loss are the 2 most significant strategies in trading for securing the profits & minimizing profits for all Traders.

Tips for Effective Stop Loss Management

1. Regularly Reassessing and Adjusting Stop Loss Levels

Dynamic Market Conditions: Cryptocurrency markets are highly volatile and can change rapidly. Set aside time at regular intervals to reassess your stop loss levels based on market movements.

Adaptability: Be flexible with your stop loss placement. If the market conditions shift or a new trend emerges, consider adjusting your stop loss to protect your gains or limit potential losses.

2. Pairing Stop Loss with Other Risk Management Techniques

Diversification: Combine stop loss orders with diversified portfolios to spread risk across different assets. This helps minimize the impact of a single asset’s downturn on your entire investment.

Hedging Strategies: Consider employing hedging strategies alongside stop loss. Options, futures contracts, or inverse ETFs can act as a hedge against potential losses, offering additional protection.

3. Using Historical Data and Trends to Inform Stop Loss Decisions

Technical Analysis: Leverage historical price data and technical indicators to identify support and resistance levels. Use this analysis to place stop loss orders strategically, aligning with key market levels.

Trend Analysis: Understand the prevailing market trends. If the market is in a strong uptrend or downtrend, adjust your stop loss levels accordingly to account for potential reversals or continuations.

4. Continuous Monitoring and Learning

Stay Updated: Keep abreast of news, events, and developments in the crypto space that might impact the market. Sudden announcements or regulatory changes can necessitate prompt adjustments to stop loss orders.

Learning from Experience: Review past trades and their outcomes. Analyze where your stop loss was placed, how the market behaved, and derive lessons for future stop loss strategies.

5. Risk-to-Reward Ratio Consideration

Balancing Risk and Reward: Assess the risk-to-reward ratio before setting stop loss levels. Ensure that potential losses are balanced against potential gains. A favorable risk-to-reward ratio can guide your stop loss placement.

Conclusion

Before concluding, I have written a detailed blog for your Trading Success – Crypto Day trading strategies. You can do Short term investments in Cryptocurrencies such as Scalping, Swing Trading or Long term investments based on your choice.

Stop loss is not just a feature; it’s the shield that guards traders against the unpredictable nature of cryptocurrency markets. Its significance extends beyond mere risk mitigation; it’s the cornerstone of responsible and strategic trading in the crypto space.

In the wild swings and volatility of cryptocurrency markets, stop loss acts as a safeguard, preventing emotional decision-making and protecting capital. It’s the tool that allows traders to define their risk tolerance and safeguard their investments in an environment notorious for rapid fluctuations.

Integrating stop loss effectively isn’t solely about setting a price point and forgetting about it. It’s an ongoing process, demanding constant evaluation and adjustments in response to market changes. Combining stop loss with other risk management strategies and market analysis is the key to building a robust trading approach.

Remember, earning money in crypto is not just by making profits, but by minimizing your losses too.

Happy Trading!